CACS Paper 2: The Definitive Study Guide

Significant changes have been introduced to the CACS Paper 2 examination over the past few years, resulting in a substantially higher level of difficulty.

This exclusive study guide is prepared by Khinloke and reflects the latest CACS Paper 2 syllabus, exam format, and question style.

In this study guide, we will explain the new question format in detail and share the most effective strategies to approach it confidently and efficiently.

We will review the most important concepts in each chapter, supported by selected questions from my exclusive CACS mock papers. The objective is to help you focus on what truly matters and minimise the time required for revision.

Let us begin.

About the Author

Khinloke has over 30 years of experience in the finance industry and professional training in Singapore, with a proven track record helping thousands of candidates pass CACS and CMFAS exams efficiently and confidently.

He has trained both early-career professionals and senior banking executives, including leaders relocating to Singapore and executives at major financial institutions.

Khinloke is trusted by premier organizations such as JP Morgan, Goldman Sachs, Morgan Stanley, Credit Suisse, Citi Bank, UOB, and DBS, among many others — delivering both individual and corporate training.

His approach is practical, exam-focused, and grounded in real industry experience, designed for busy professionals who want to prepare effectively without unnecessary complexity.

Key Things You Must Know Before Exam Day

1) Time Management

Time management has always been important for CACS candidates. However, since February 2019, changes to the exam format have altered how candidates should approach the paper.

Exam duration increased from 2 hours to 2.5 hours

Number of questions reduced from 100 to 80

Passing mark remains at 70%, meaning you can only afford to get 24 questions wrong

While candidates now have more time per question, the introduction of a new question format has added a new layer of complexity.

2) New CACS Paper 2 Question Format

The most critical change is the introduction of a multiple-response multiple-choice format.

Unlike the old format, each question may have more than one correct answer.

This significantly reduces the effectiveness of guessing. Previously, candidates had a 1-in-4 chance of guessing correctly. With the new format, the probability of guessing correctly drops to approximately 1 in 15.

A Practical Exam Tip

When you encounter a question you are unsure of, select all available options.

You will then receive a system prompt indicating how many correct answers there are (e.g. “There are only 2 correct answers”).

This immediately narrows your choices and significantly improves your chances of selecting the correct combination.

This technical behaviour was observed when the new format was introduced in early 2019. You are encouraged to try this during your exam and observe whether it remains applicable.

3) CACS Formula Sheet

There is no need to memorise any formulas.

The official formula sheet—identical to the one published in the IBF Study Guide (pages 175 to 185)—will be provided during the examination.

4) IBF Official CACS Study Guide

The official IBF CACS Study Guide will be available for download from IBF.org.sg after you have enrolled for the CACS Paper 2 exam.

If you require the study guide prior to enrolment, please complete the form provided below.

5) Calculator

Candidates are required to bring their own calculator.

A scientific calculator is recommended over a financial calculator, as it is generally more efficient for exam calculations.

You are also allowed to bring more than one calculator, which is strongly encouraged as a backup.

Short on time to prepare?

Access exclusive CACS mock exam papers with detailed, question-by-question debriefs and direct references to the relevant textbook sections — designed to help professionals prepare efficiently and with confidence.

CACS Paper 2: Chapter-by-Chapter Analysis

This study guide follows the structure of the official IBF Study Guide closely.

IBF CACS Study Guide Chapters:

This Study Guide focuses on Chapters 1 to 5.

The following chapters are listed for reference but not covered in this study guide:

Chapter 6: Fund Solutions

Chapter 7: Alternative Investments

Chapter 8: Derivatives Markets

Chapter 9: Structured Products

Chapter 10: Use of Credit and Leverage

Chapter 1: Portfolio Management Process

The primary focus of this chapter is Portfolio Performance Attribution.

In the exam, you can expect 1–2 case study questions and 7–8 standard questions.

Pay close attention to:

Formula 5: Portfolio Returns

Formula 9: Portfolio Risk

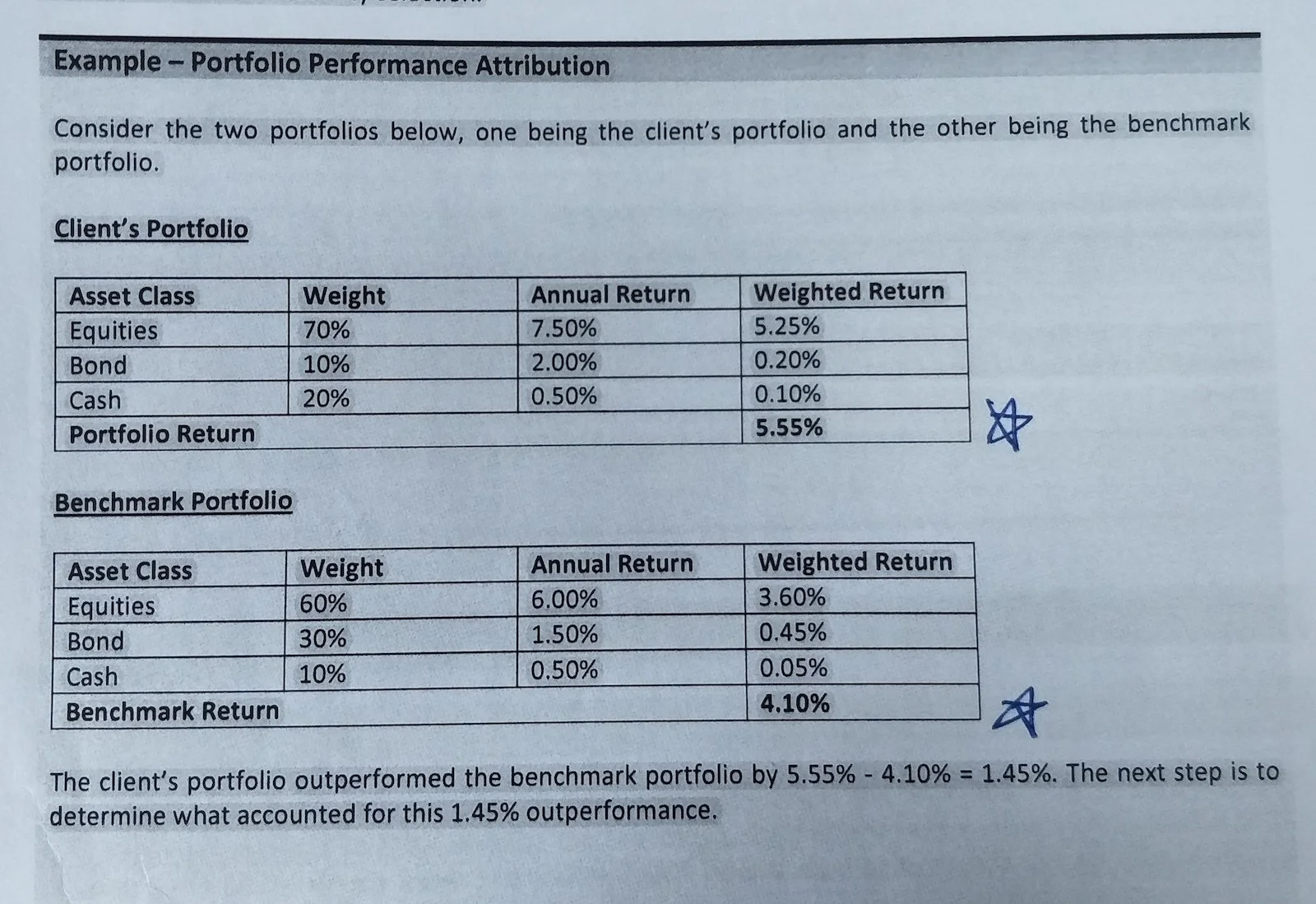

We will now walk through a representative case study from the IBF Study Guide (page 10) to illustrate the typical question format.

Case Study – Part A

You may wonder why a benchmark portfolio is used and how it is constructed.

In practice, the benchmark is based on the client’s risk profile:

Younger clients typically hold more equities (higher risk)

Older clients typically hold more bonds (lower risk)

This background knowledge is not essential for solving exam questions, but it provides useful context.

You are almost guaranteed to be asked whether the client’s portfolio outperformed or underperformed the benchmark.

Before answering the case study, you should construct two separate tables based on the data provided.

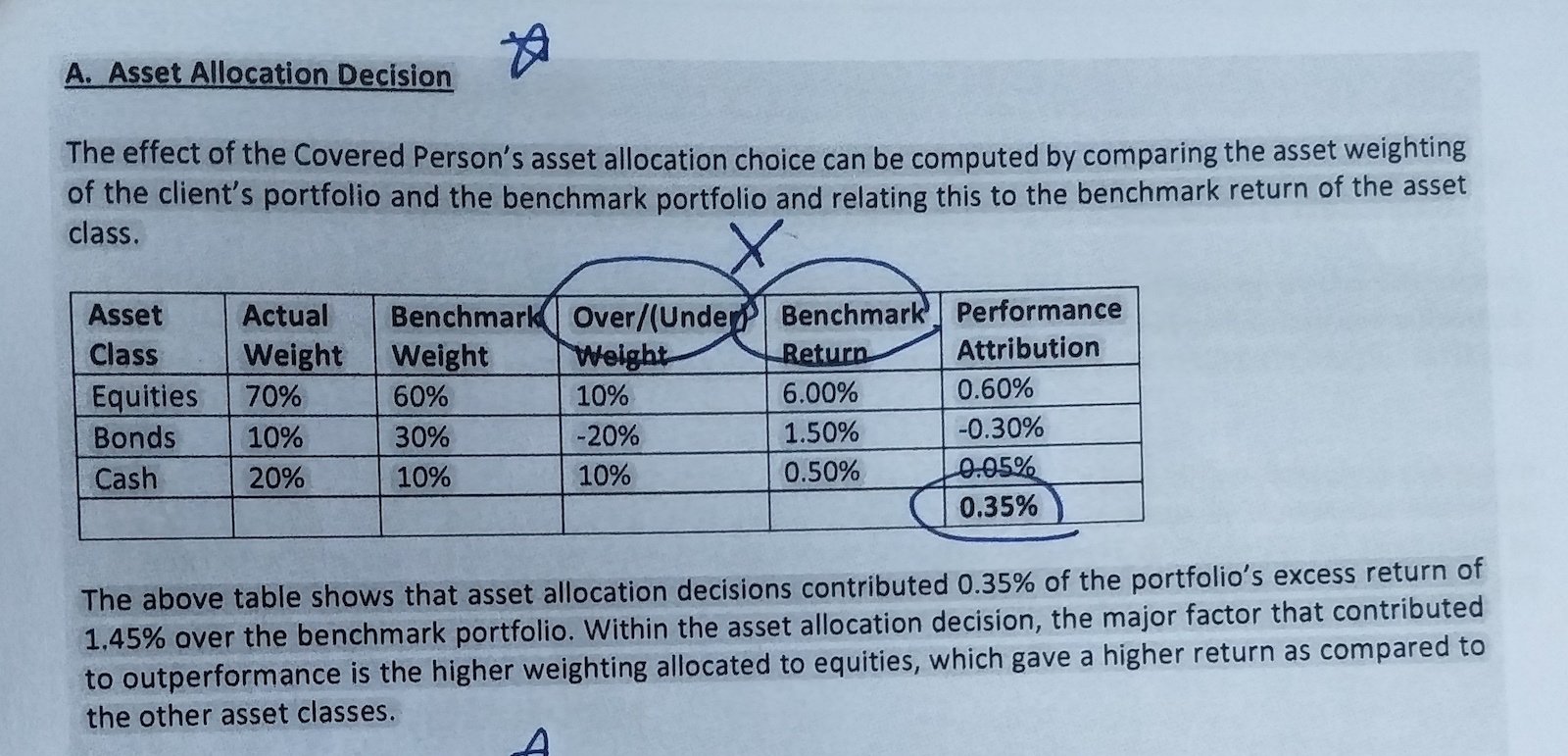

To determine the asset allocation effect, multiply the overweight or underweight by the benchmark return.

Case Study – Part B

This calculation gives you the performance attribution for each asset class.

You can then sum the values to determine how much asset allocation contributed to the portfolio’s excess return over the benchmark.

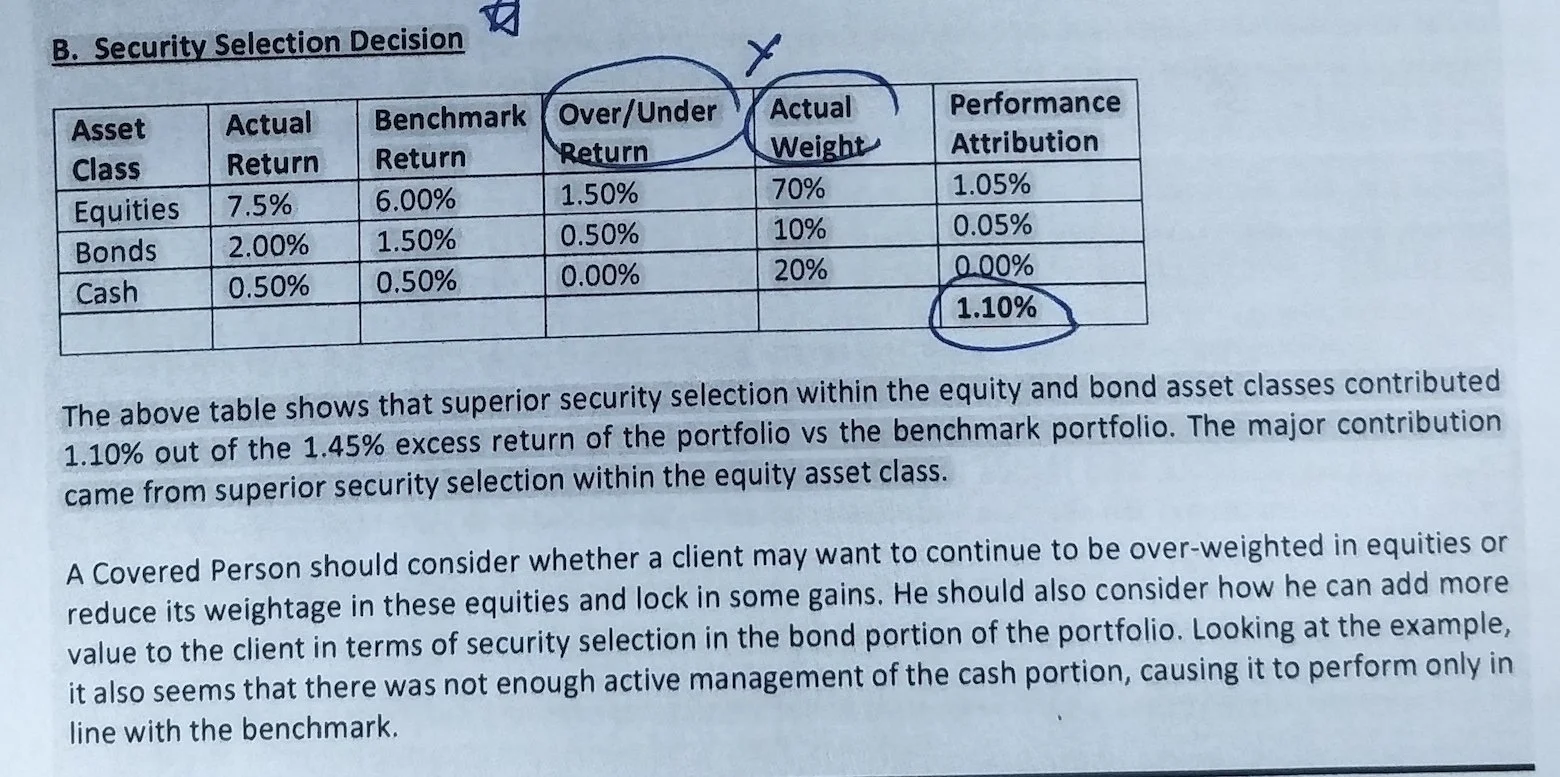

To determine the security selection effect, multiply the over- or under-return by the actual portfolio weight.

Case Study – Part C

This calculation gives you the performance attribution for each asset class due to security selection.

Summing these values allows you to determine how much security selection contributed to the portfolio’s excess return over the benchmark.

Chapter 2: Macroeconomic Analysis

This chapter focuses primarily on the Impossible Trinity (IBF Study Guide, page 21).

Exam weightage is relatively low and you can expect 1 case study question and 2–3 standard questions.

It is essential to understand how:

The U.S. Federal Reserve conducts monetary policy through interest rates

The Monetary Authority of Singapore (MAS) manages policy via the S$NEER, not interest rates

What is S$NEER?

The Singapore Dollar Nominal Effective Exchange Rate (S$NEER) represents the value of the Singapore dollar against a basket of currencies from major trading partners.

Chapter 2 Case Study (Example)

Question 2.1

What will happen to interest rates in Singapore when the U.S. Federal Reserve raises its interest rates?

A. Singapore’s interest rates will remain unchanged

B. Singapore’s interest rates will fall

C. Singapore’s interest rates will rise

D. Singapore’s interest rates will either rise or fall

Answer: (C)

Singapore does not set its own interest rates directly. Interest rates are influenced by the S$NEER.

When the U.S. Federal Reserve raises interest rates and the S$NEER remains unchanged, Singapore’s interest rates will rise.

Question 2.2

During the 2008–2009 Global Financial Crisis, there was a significant deterioration in external demand. How did the MAS respond? (Select all that apply.)

A. The S$NEER was re-centered higher

B. Gradual easing of monetary policy

C. Gradual tightening of monetary policy

D. The S$NEER was re-centered lower

Answer: (A) and (B)

The S$NEER was re-centered higher to strengthen the Singapore dollar, helping to counter weak external demand and attract capital inflows.

Monetary easing contributed to lower interest rates, encouraging borrowing and spending, thereby stimulating the economy.

Fast-track your CACS preparation

For candidates seeking a more efficient preparation approach, Khinloke’s CACS mock exam papers provide structured practice with clear question-by-question debriefs and textbook references.

Chapter 3: Foreign Exchange Analysis

This chapter is calculation-intensive.

Exam coverage includes 1 case study and 3–4 standard questions.

Key areas to master:

Cross-rate calculations

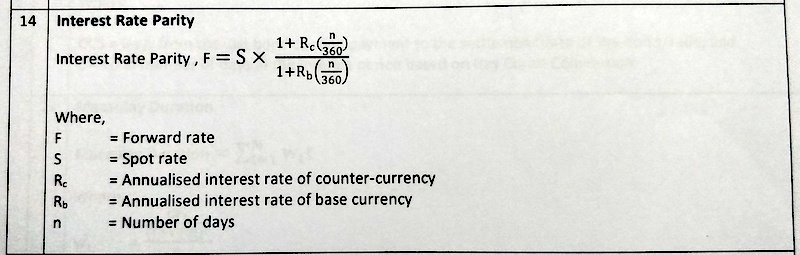

Interest Rate Parity (Formula 14)

While exchange rates are often quoted against USD, exam questions frequently require you to calculate cross rates that do not involve USD directly.

Chapter 3 Case Study

Mrs Chan lives in Singapore and has a son studying in Australia. She wants to lock in a 3-month forward exchange rate to pay AUD 30,000 for her son’s university tuition.

Given:

Spot USD/SGD: 1.3500

3-month SGD interest rate: 1.50% p.a.

Spot AUD/USD: 0.7500

3-month AUD interest rate: 3.50% p.a.

Question 3.1.1

What is the spot AUD/SGD rate?

AUD/USD × USD/SGD = AUD/SGD

0.7500 × 1.3500 = 1.0125

Answer: (C)

Question 3.1.2

One week later, the spot AUD/SGD rate is 1.0300. What is the 3-month outright AUD/SGD rate? (Assume a 360-day year.)

Using the Interest Rate Parity formula, the correct answer is 1.0249.

Answer: (C)

Question 3.1.3

Mrs Chan enters the forward contract at a spot rate of 1.0074. At maturity, the spot rate is 1.0200. What is her final net position?

At contract entry:

AUD 30,000 × 1.0074 = SGD 30,222

At maturity:

AUD 30,000 × 1.0200 = SGD 30,600

Difference:

30,600 − 30,222 = SGD 378

Answer: Mrs Chan is better off by SGD 378 (A).

Chapter 4: Fixed Income Analysis and Strategies

This is a relatively high-scoring chapter.

You can expect 1 case study and 3–4 standard questions.

You should be familiar with:

S&P credit ratings

Bond price quotations

Clean price vs. dirty price

U.S. Treasury price quotations

Understanding accrued interest calculations is particularly important.

Chapter 4 Case Study

Mr Tan intends to purchase an investment-grade senior unsecured USD bond.

Bond details:

Coupon rate: 3.5% (annual)

Remaining tenor: 3 years

Price quote: 100.5

Notional value: USD 200,000

Last coupon paid: 180 days ago

Assume a 360-day year

Question 4.1.1

How much does Mr Tan need to pay?

Clean price:

200,000 × 100.5% = USD 201,000

Accrued interest:

200,000 × 3.5% × 180/360 = USD 3,500

Dirty price:

201,000 + 3,500 = USD 204,500

Answer: (A)

Chapter 5: Equity Analysis and Strategies

This chapter focuses on financial ratio analysis.

There is typically 1 case study question.

Chapter 5 Case Study

Company ABC Financial Data:

Current Assets: $100,000,000

Current Liabilities: $50,000,000

Inventory: $10,000,000

Long-Term Debt: $100,000,000

Total Equity: $30,000,000

Net Income: $5,000,000

Net Sales: $25,000,000

Question 5.1.1

Which financial ratio raises a red flag?

Calculations:

Debt-to-equity ratio:

100,000,000 / 30,000,000 = 3.33 (High leverage)Net profit margin:

5,000,000 / 25,000,000 = 0.20Return on equity:

5,000,000 / 30,000,000 = 0.1667Current ratio:

100,000,000 / 50,000,000 = 2.0

Answer: (A) Debt-to-equity ratio

Pass the CACS exam with clarity, not guesswork

CACS Paper 2 is no longer a test of memorisation—it is a test of understanding, application, and exam strategy.

If time is limited or self-study feels uncertain, Khinloke’s CACS mock exam papers offer a proven, exam-focused path — combining realistic questions, expert question-by-question debriefs, and clear references to core concepts.